By now you’ve probably seen in the news that the Reserve Bank of Australia (RBA) lowered the official cash rate from 1.50% to 1.25% last week, after almost 3 years of inactivity.

While a rate cut is certainly good news for mortgage holders (which should see a decrease in most variable rate loan repayments) that’s sort of where the good news ends. Despite (suspiciously ) positive sentiment from some political figures, the economy isn’t actually doing so well. Employment and inflation are still tracking well below RBA targets, with inflation for the March quarter of 2019 coming in at a big fat 0.0%.

The GOOD news, however, is that the drop in house prices seems to be levelling out, with talk of an uptick (albeit a slow one) on the horizon. This may help things along, economically speaking, which brings us to…

Rate discounts to be passed on by the major banks

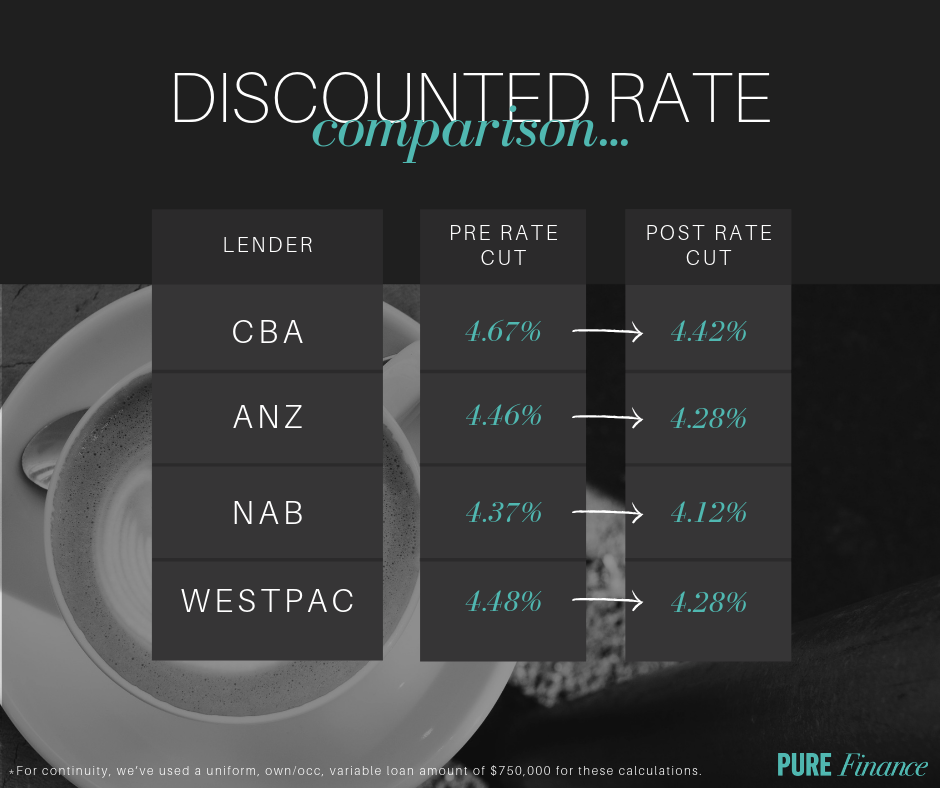

Now that the dust has settled, the major banks have released their respective rate discounts to be passed on to mortgage customers, and it’s an interesting array of offerings:

Many have been quick to condemn both ANZ and Westpac for not passing on the full cut to customers, but it’s important for borrowers to remember that what really counts here is their final rate (or ‘net’ rate). This is the rate you’re left with at the end which is often dependant on the discount that is applied to your loan in its entirety. It is this rate that ultimately dictates what your repayments look like, and that is what really counts.

It’s kind confusing (naturally) so we’ll try and explain it a bit more… with coffee!

Let’s say your favourite café charges you $4.00 for your morning coffee, and because you’re a regular, they offer you a ‘loyal customer’ discount of 80c. This makes your coffee price $3.20.

The café next door charges $4.00 for the exact same coffee, but they offer a loyalty discount of 20c for regular customers, which means a coffee from them would be $3.80.

Now let’s imagine that the coffee industry isn’t doing so well, and, in the interest of boosting sales, all cafes are advised to discount the prices of their coffees by an industry wide 50c.

Your café already prices their coffee a little cheaper than the guys next door, with a pretty generous loyalty discount. So for them, passing on the full 50c might make things a little tight for profit margins. The guys next door price their coffee a little higher to begin with, so they’re in a much better position to pass on the extra 50c discount.

If we come back to the banks for a moment, and we look at what they were offering in terms of discounted rates pre RBA cut vs. post cut, we get something like this:

Interestingly, there are a few things to note:

- Despite passing on the full rate cut, CBA still comes in as the most expensive in the comparison, with a post cut rate of 4.42%

- Similarly, while Westpac passed on 20 basis points compared to ANZ’s 18, they still wind up being an equal second place post cut at 4.28%

As always, the devil is in the detail, and it is imperative that either you (or your mortgage broker) are negotiating hard with the banks to ensure you’re not getting stung. The rates listed in the comparison above are standard 'discounted' bank rates, which means that if you were to walk into a bank to get a home loan, this is what they might offer you. Mortgage brokers have access to heavily discounted rates that are not advertised by the banks and currently, these rates are sitting around 3.75% pre rate cut and 3.57% post rate cut. Sooooo, if your variable rate home loan has a 4 in front of it, you are ABSOLUTELY paying too much! (we really hate getting salesy, but we think it’s super important that you know what your options are…)

Your best defence? Annual Reviews

It's times such as these that really highlight the absolute best way to get the most out of your mortgage, and that is: to review it. And we’re not talking just when there is RBA activity, but regularly.

Like, really regularly…

Now of course, that’s a very annoying and time-consuming task for your average mortgage holder, which is why we offer our annual review loan management service to all Pure Finance clients, for as long as they have their loan with us. Every single day, we’re not only helping new home buyers achieve their property purchase goals, but we’re also reviewing the loans of our existing clients, ensuring that their loans stay competitive and market leading. You can see the savings achieved for our clients during the first quarter of 2019 here!

So, what does it all mean for you?

At 1.25%, the cash rate is now the lowest it’s been since the 1960’s and back then, house prices were around $20,000! Fast forward to 2019, and we are now able to borrow money at similar interest rates as the baby boomers when they were buying their first home. And while we’re always at pains to engage in any kind of predictive conversation, the majority of Australia’s economists are forecasting even more rate cuts on the horizon.

I already have a home loan

Over the next 1-3 weeks, the banks will automatically pass on some or all of the 0.25% reduction to new and existing customers that have variable home loans (existing fixed rates remain the same).

This means that if you have a variable home loan interest rate of 3.75% and your bank passes on the whole 0.25% reduction, then you can expect to have a new interest rate of 3.50% in a matter of weeks and no action is required for this to take affect!

*Hot tip*

For anyone with a mortgage, we STRONGLY recommend keeping repayments the same, and if possible, make some extra ones! Remember that the long-term plan for interest rates is upwards, and if you can really get stuck into that principle now, you’ll be in a much better position when rates do start to rise.

I haven’t bought a property yet (but I’m thinking about it)

If you’re thinking about buying a property in the future, then your forecasted home loan repayments just got cheaper.

Buying a property is a big decision so it’s important you don’t rush into it just because others are doing it, but if you genuinely want to own a property, then we’d be love to work with you to show you what the repayments would be for your own situation. In some cases, the repayments are comparable to the rent you’re currently paying, so it’s worth exploring.

I just want wine

Analysis paralysis? If you’re not sure about any of the above and perhaps just want to drink some beautiful wines from WyNo Bar in Surry Hills, then keep reading...

Our Wine + Wisdom event series, in conjunction with Fox & Hare, is designed to help demystify the process of buying a property and also, setting financial goals. You’ll also hear about superannuation + ethical investing, and it’ll be fun because #wine.

Spaces are always very limited so click here to register your interest in our August event.

Cash rate anxiety? Let’s talk it out!

1300 664 603

or

The preceding information is of a general nature and does not take into account personal financial situations and endeavours. You should obtain advice based on your individual circumstances before acting on the above information.