Note: We are regularly updating this article as the situation surrounding COVID-19 continues to change.

First and foremost, we hope that you and your loved ones are managing to stay safe during these difficult and challenging times. As we’re sure you’re aware, the situation surrounding COVID-19 is changing rapidly, as is Australia’s response to the pandemic. Aside from its devastating health impacts, there are likely to be even further financial impacts caused by Coronavirus and we want to make sure that you have the information you need to make it through the days and weeks to come.

What can I find in this article?

With the Government announcing its second economic stimulus package on the weekend, there are a range of measures being put in place to increase support for small businesses and sole traders, welfare recipients, and anyone that finds themselves out of work as a result of the COVID-19 pandemic.

In the following article, we’ve aimed to outline all of the new measures being implemented, with links to relevant fact sheets for further information and eligibility requirements.

There’s a lot of information to get through, so, to help you find what you’re looking for we’ve laid things out as follows:

1.Financial Support for Individuals + Households

1a. Income Support

1b. Stimulus payments

1c. Temporary early access to superannuation

1d. Loans + repayments

1e. Other debts and liabilities

2. Financial Support for Businesses

2a. Boosting cash flow for employers

2b. Supporting apprentices and trainees

2c. Loans + repayments for businesses

2d. Coronavirus SME Guarantee Scheme

2e. Temporary relief for financially distressed businesses

3. Business Investment Incentives

3a. Increases to the instant asset write-off + backing business investment

4. Financial Counselling and other helpful links

*Note: With regards to individual benefits, we think it’s worth checking your eligibility regularly as the situation is constantly changing, and you may be eligible for support that you weren’t eligible for previously. As things change, we’ll also be doing our best to keep you informed as well as updating this article as necessary.

So, what is available and how can it help you?

1. Financial support for individuals + households

1a. Income support

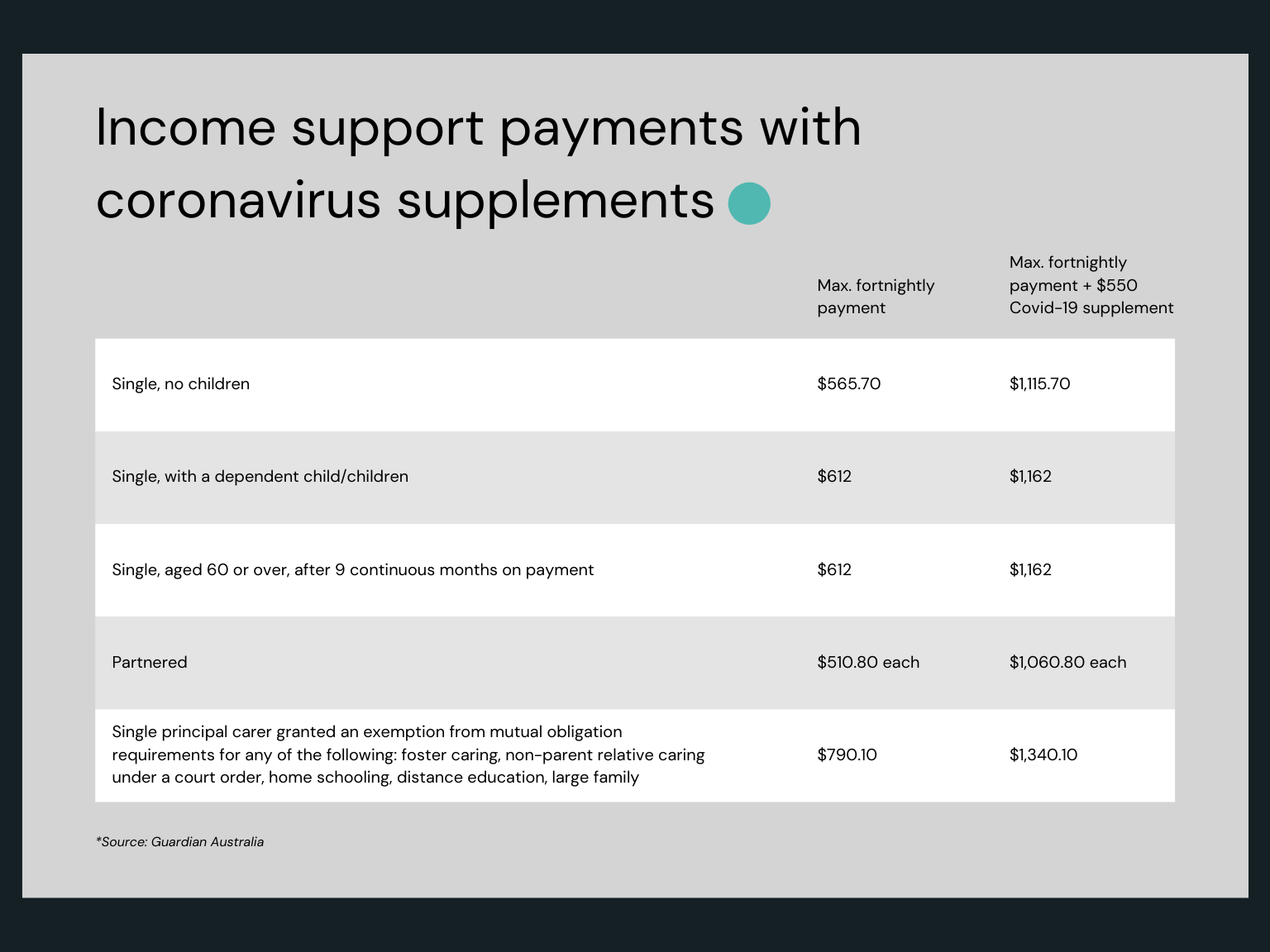

Over the next six months, the Government is temporarily expanding eligibility criteria to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight. For those currently receiving income support (Formerly ‘Newstart’ now named the ‘Jobseeker’ payment) this new payment will be in addition to your current allowance, and will effectively double it.

Expanded eligibility for income support will include those who are stood down or lose their employment as a result of the economic downturn caused by COVID-19 including: sole traders; self-employed; casual workers; and contract workers who meet the necessary income tests. This supplement can also be accessed if you are required to care for someone who is affected by the Coronavirus.

More info and eligibility requirements for income support can be found here.

*Note: As of today (Wed 25th March, 2020) there has been a lot of disruption and confusion around the best way to apply for income support, especially for those who are new to the system. To help you or someone you know to navigate the process, the Guardian has put together a very helpful explainer here.

1b. Stimulus payments

The Government is also providing two separate $750 payments to those who receive social security, veteran and other income support, and eligible concession card holders, with an estimated half of those eligible being pensioners. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020.

*Note: You cannot receive the second payment if you are eligible for the $550 per fortnight Coronavirus supplement payment.

More info and eligibility requirements on stimulus payments can be found here.

1c. Temporary early access to superannuation

The Government is also allowing individuals affected by the Coronavirus to access up to $10,000 of their superannuation in the 2019-20 financial year (July 2019 - June 2020) and a further $10,000 in 2020-21. Individuals will not need to pay tax on the amounts released and the money withdrawn will not affect Centrelink or Veterans’ Affairs payments.

More info and eligibility requirements on early access to superannuation can be found here.

*Note: It’s really important to remember that withdrawing from your super early can have a significant impact on the amount that you’re left with when it comes time to retire, because of the compound interest you miss out on. It’s also important to be mindful that for many of us, our super will have already taken a hit due to the market volatility we’ve seen over the last few months. So, we’d really encourage you to speak to a financial adviser about your personal circumstances on this one.

1d. Loans + repayments

For those with a mortgage, it’s important to remember that, if you are facing financial hardship during this time, there are options available to you. All banks in Australia have a financial hardship team and they are available to help come up with a temporary solution to support you through a period of financial difficulty. Options such as a ‘repayment pause’, or extension of your loan term, are some of the most common arrangements that can be made and remember that applying for financial hardship does not affect your credit rating. It is a confidential arrangement between you and your lender.

*Note: A pause on home loan repayments doesn’t mean a pause in the interest you will accrue during this time, which unfortunately means that borrowers will be looking at higher costs in the long term if they do defer payments. Again, if you have ANY questions or concerns around this, please get in touch. This is what we are here for!

More information on applying for financial hardship can be found here.

1e. Other debts and liabilities

Similarly, if you’re experiencing difficulty meeting your credit card or personal loan repayments, don’t hesitate to reach out to your bank or provider to try and work out a temporary solution to help you through this period of uncertainty.

2. Financial Support for Businesses

2a. Boosting cash flow for employers

The Government is providing $20,000 - $100,000 to eligible small and medium-sized businesses (SMEs) and not for-profits (NFPs) to help with cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff. Businesses and NFPs are eligible if their entities have an aggregated annual turnover of $50 million or under and if they employ workers.

Under the scheme (which will be administered in two phases), employers will receive a payment equal to 100 per cent of their PAYG withholding from the period relating to 1 January to 30 June 2020. The minimum payment will be $10,000 up to a maximum payment of $50,000.

Then in Phase 2 (providing that the business remains active), an additional payment will also be introduced between July – October 2020, with eligible businesses to receive an additional payment equal to the payment they received in Phase 1. This means that eligible businesses and NFPs can receive between $20,000 and $100,000 under the scheme.

*Note: The payment will be tax free and delivered by the ATO as a credit upon lodgement of your activity statements. Where this places the entity in a refund position, the ATO will deliver the refund within 14 days.

This one is a bit complicated (but very useful) so make sure you speak with your accountant about your personal circumstances and you can find more info + eligibility requirements for the scheme here.

2b. Supporting apprentices and trainees

The Government is also supporting small businesses to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage paid during the nine months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

More info + eligibility requirements for apprentices and trainees here and for further information on how to apply for the subsidy, contact an Australian Apprenticeship Support Network (AASN) provider here.

2c. Loans + repayments for businesses

The Australian Banking Association (ABA) has announced that small businesses will be able to access a six-month deferral of all loan repayments, providing some relief for those experiencing immediate financial impacts of the pandemic. Businesses can access the Payment Deferral Scheme by registering with their bank.

Some banks have already outlined their specific emergency relief packages in response to the Coronavirus here. However, if your bank doesn’t appear on this list, you can find more information on financial hardship options on the ABA website here.

*Note: If you defer loan repayments, you will still accrue interest during the deferral period.

2d. Coronavirus SME Guarantee Scheme

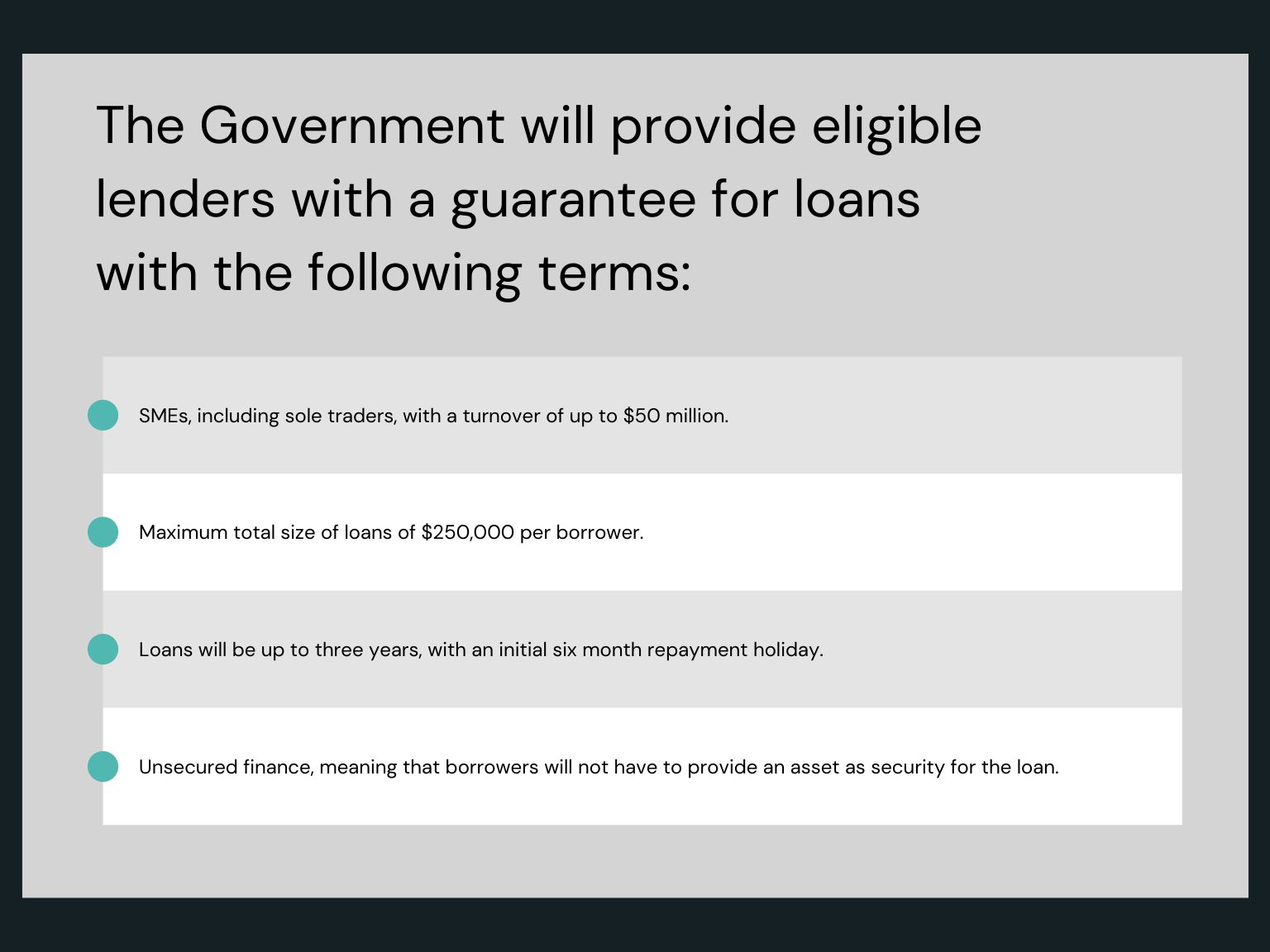

For those with the need and capacity to borrow more money to cover any shortfall, the Government has also announced a new Coronavirus SME Guarantee Scheme, which will support lending to SMEs worth $40bn or less.

The Scheme will enhance lenders’ willingness and ability to provide credit, supporting many otherwise viable SMEs to access vital additional funding to weather the impact of Coronavirus.

*Note: The Scheme will be available for new loans made by participating lenders until 30 September 2020 and you can find out if your business is eligible for the Coronavirus SME Guarantee Scheme here

2e. Temporary relief for businesses in financial distress

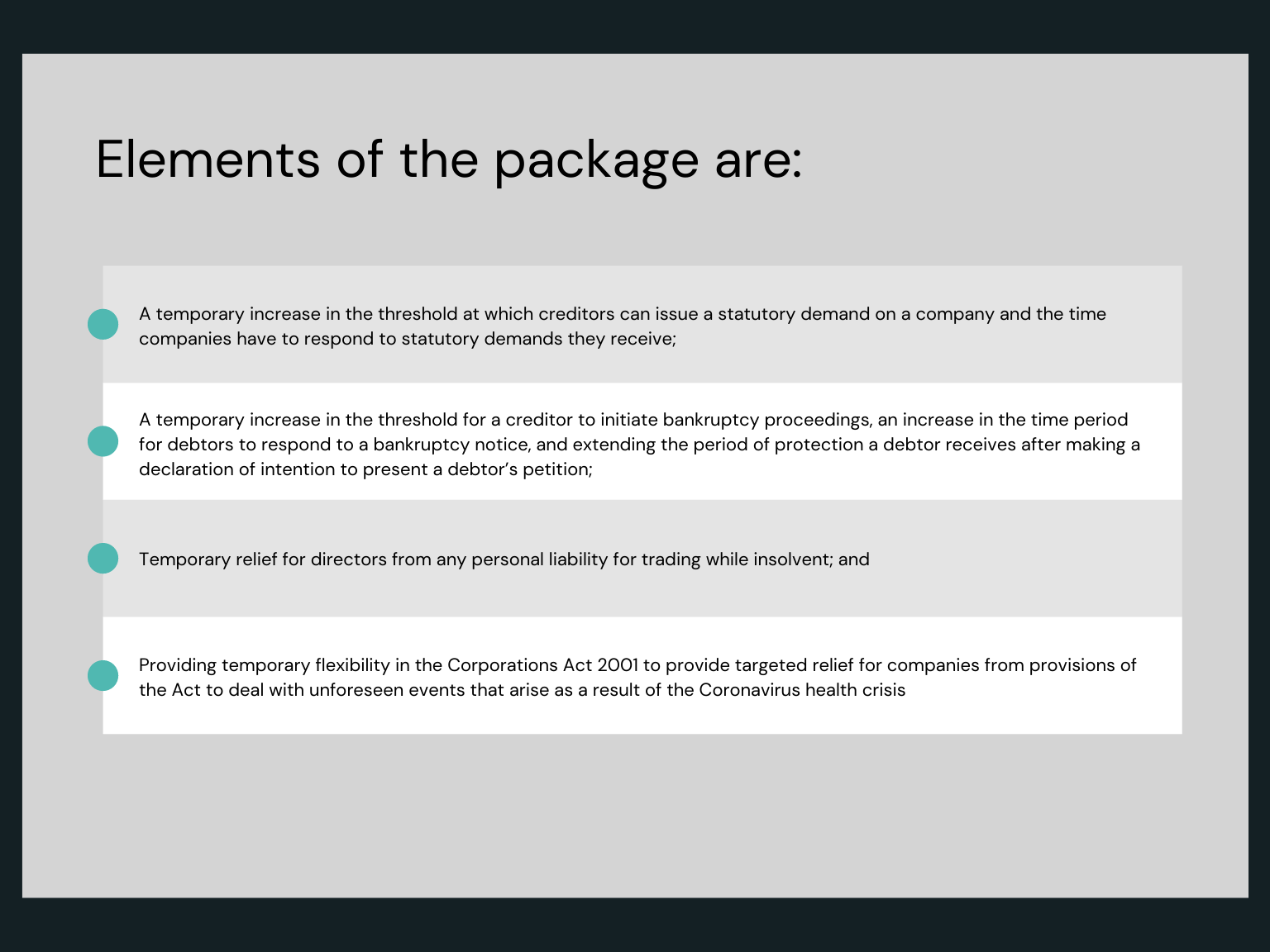

The Government is temporarily increasing the threshold at which creditors can issue a statutory demand on a company and the time companies have to respond to statutory demands they receive.

For owners or directors of a business that are currently struggling due to the Coronavirus, the ATO can tailor solutions for their circumstances, including temporary reductions of payments or deferrals, or withholding enforcement actions including Director Penalty Notices and wind-ups. For more information on temporary relief measures, click here.

3. Business investment incentives

3a. Increases to the instant asset write-off + backing business investment

To encourage spending and stimulate the economy at this time, the Government is increasing the instant asset write-off (IAWO) threshold from $30,000 to $150,000 and expanding eligibility to include all businesses with an aggregated annual turnover of less than $500 million until 30 June 2020. This will allow businesses to immediately deduct purchases of eligible assets that are less than $150,000. The threshold applies on a ‘per asset’ basis, so eligible businesses can immediately write-off multiple assets in a year.

In addition, the Government is also introducing a time limited 15-month investment incentive (through to 30 June 2021) by accelerating depreciation deductions. Businesses with a turnover of less than $500 million will be able to deduct 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.

More info + eligibility requirements for business investment incentives can be found here.

4. Financial Counselling and other helpful links

If you’re concerned about your financial situation and would like to speak to someone about it, you can connect with a free, independent and professional financial counsellor by calling the National Debt Helpline – Free financial counselling on 1800 007 007.

- The Australian Government’s COVID-19 homepage: provides a summary of the new measures introduced to provide additional financial support to Australians, with links to key updates across the country as well as state-specific information.

- The Treasury’s support for individuals and households: includes downloadable fact sheets for a range of new financial assistance measures.

- The Treasury’s support for businesses: explains how the Australian Government will assist businesses.

- Services Australia COVID-19 Homepage: provides direct links for how to claim government support across a range of individual circumstances, including job seekers, older Australians, people with a disability, students, trainees and more.

As the situation is constantly evolving, so too is the response from the Government as they try to minimise the varied impacts of the COVID-19 pandemic. We will try our very best to keep you updated as new information comes to light, as well as any changes that are made along the way.

Stay safe (and informed) and take care of each other. And, as always, we are here to provide you with any information or assistance you might need during this time. Our door is always open, though, it might be best if we do things via phone or email for a little while...

If you need us:

1300 644 603

info@nullpurefinance.com.au