We have always held the view that just because a client’s loan is successfully settled at a great rate, that doesn’t mean the work is over.

For us, it’s just the beginning of a long-term working relationship, that will see our clients reap the benefits of our industry first annual reviews where, year after year, we continually negotiate with their chosen lender to ensure the lowest possible costs on their loan are maintained. Short of making additional repayments, we believe it’s one of the most effective ways to ensure you are maximising efficiency when it comes to paying off your loan, and sooner.

As a way to help quantify the benefits of our annual review system, we’ve put together a summary of the results achieved for our existing clients for the second quarter of 2019. Take a look!

THE STATS | Q2, 2019

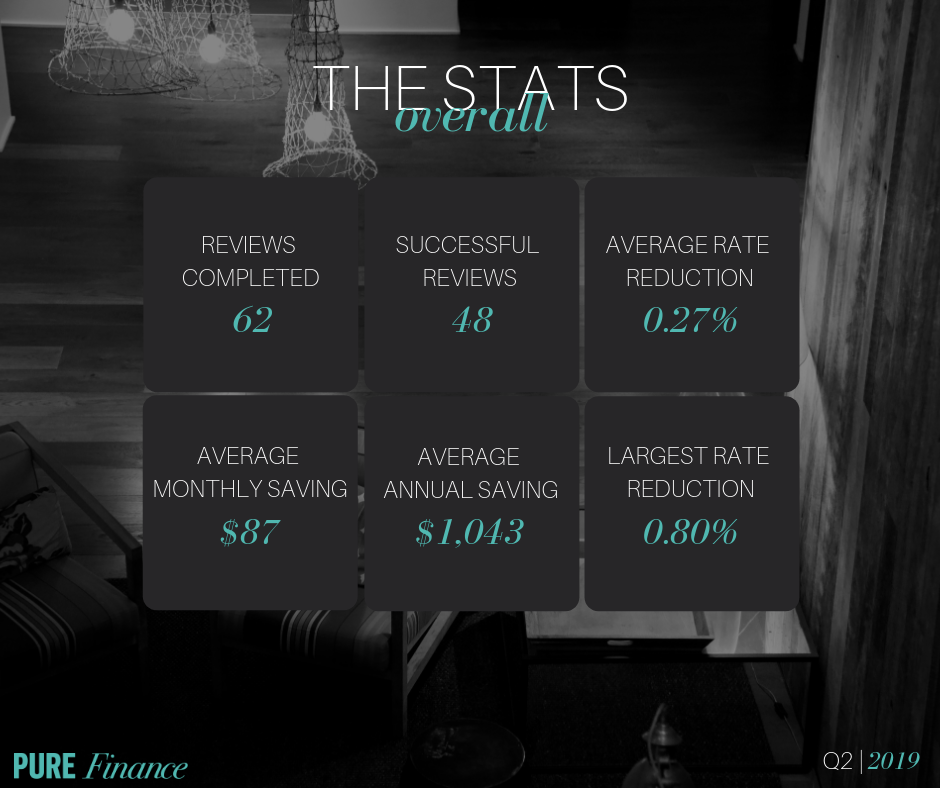

OVERALL

For the second quarter of 2019, Pure Finance conducted 62 interest rate reviews for existing clients. Of these 62 reviews, 48 were successful in achieving increased interest rate discounts.

An average additional rate reduction of 0.27% was achieved as a result of these reviews. This equates to an overall average monthly saving of approximately $87, or approximately $1,043 annually.

The largest rate reduction achieved was 0.80%.

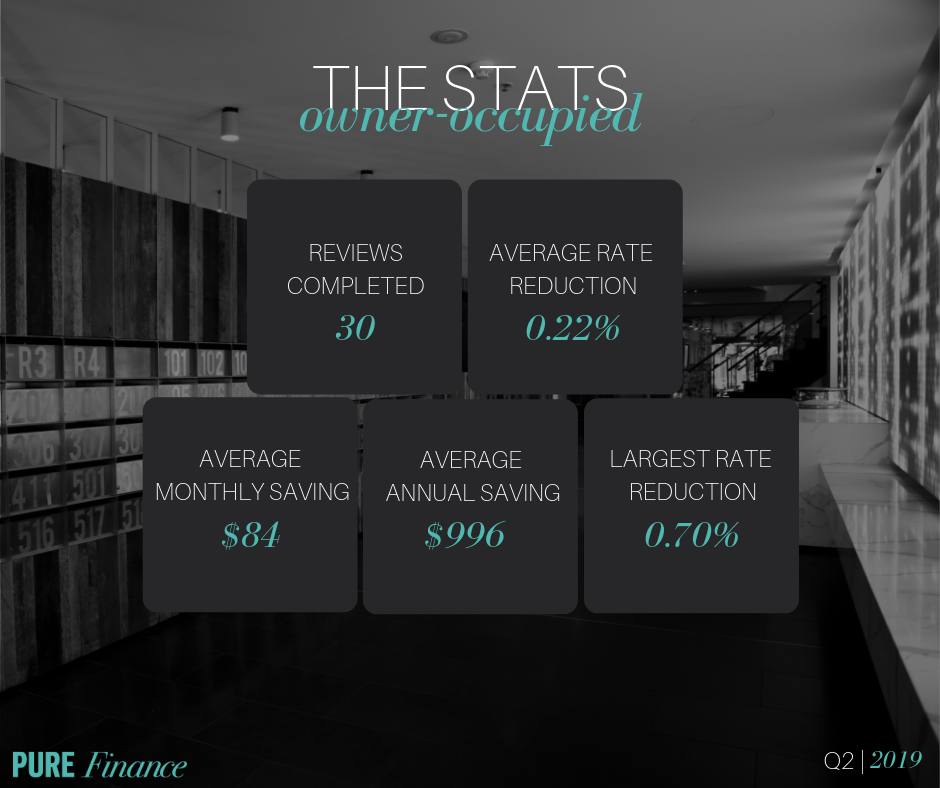

OWNER OCCUPIED

Of the successful reviews, 30 were for owner-occupied facilities. Across the facilities, an average rate reduction of 0.22% was achieved, which equates to an approximate average monthly saving of $84, or approximately $996 annually.

The largest owner-occupied rate reduction was 0.70%.

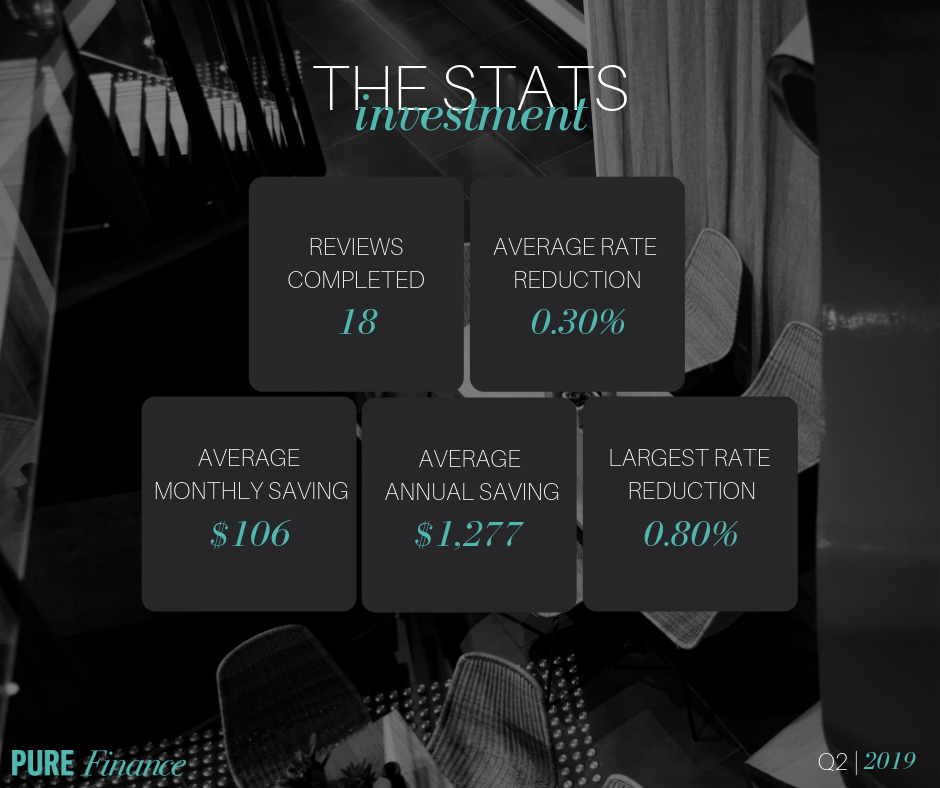

INVESTMENT

The remaining 18 successfully reviewed rates were for investment facilities, where an average rate reduction of 0.30% was achieved. This equates to an average monthly saving of approximately $106, or approximately $1,277 annually.

The largest investment rate reduction achieved was 0.80%.

*We're upping the ante... the above calculations outline actual savings, calculated over remaining loan terms.

If you suspect you might be paying too much on your home loan, or if you’re interested in taking advantage of our annual review loan management system, we’d love to hear from you!

You can reach us here: 1300 664 603

or here: info@nullpurefinance.com.au