For many of us, owning a property is high on our list of life goals. Whether you’re looking for a home to live in, or one to invest in, we are here to help. From budgeting to scenario planning, and helping you figure out how much you can borrow while still living the life you love, we provide jargon-free, money and time-saving support to ensure your loan remains the best in the market year after year.

We’re a team of mortgage advisers ready to change what you think working with a finance company is all about.

Better finance, pure and simple.

Services

There is a pesky misconception about ethical finance. One that reinforces the idea that we have to compromise on returns, or the quality of the service we’re being provided, to align our finances with our ethics and values.

Since 2011, we’ve been on a mission to prove that ethical and purposeful finance is better in every respect, and that choosing what is right should never have to be a compromise. That means no one size fits all approach, no jargon, no hidden fees, just a whole lot of expertise and love.

So, if you are hoping to secure a new home or investment property, dream of starting or expanding your business, or perhaps need a shiny new pair of wheels to drive around on – if you want it, we’ll help you get it. Here’s how…

Finance for:

-

A home

Residential Home Loans

Here are a few of our recent client stories:

-

A car

Car + Asset Loans

Need a shiny new pair of wheels? We got you. Whether it’s a new electric vehicle, a snazzy sports car, or new SUV to fit your expanding family – we’ll find you the best deal possible so you can drive away, with a manageable loan to pay.

Here are a few of our recent client stories:

-

A business

Business + Equipment Loans

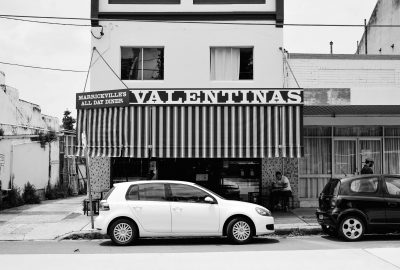

We love helping budding business owners to make their dreams a reality. We’ve been involved in securing funding for some of the best businesses around town, from award-winning restaurants, to hole in the wall stores across a range of industries. So, whether you need a loan to start a new business, expand a side hustle or buy an existing business, we are here to help you go after what you want.

Here are a few of our recent client stories:

-

Something else

Need money for something 'out of the box'? There's a loan for that too.

Helping you secure finance to help you achieve your goals is all part of the deal at Pure Finance. Be it an office building, commercial factory or even a block of apartments – we work hard to find the right solution for you and make sure it stays that way through our complementary annual rate reviews.

Here's how we do it.

Our process

It all starts when you reach out, wanting a loan or even just to talk about your options. Because no person, and no finance journey, is the same – neither are the options that we present to you. They will be suited to you, your goals and the financial institutions you want to work with.

And don’t worry – around here, we like to create a jargon and BS-free environment because the financial system is confusing enough without feeling like you need to speak a whole other language.

So, here’s what to expect when you work with us…

Getting started

Giving you options

Getting the ducks in a row

The green light

Getting settled

Happy days!

Because a home loan should never be set + forget.

Annual reviews

The thing about taking out a great home loan is… it doesn’t always stay great. That’s why we’ve instituted our industry-first annual rate review process where we continually negotiate with your chosen lender to ensure the lowest possible costs on your loan, year after year.

Last year, we found better rates for our customers, saving them a whole lot of time and money. Here are the numbers:

Reviews Conducted

Avg. Rate Reduction

Avg. Monthly Saving

Avg. Annual Saving